I am what the Australian Government likes to call a "self-funded retiree" which means

that, unlike the majority of Australians who rely on social security hand-outs, I

haven't been pissing my money up against the wall but saved it for my retirement.

I am what the Australian Government likes to call a "self-funded retiree" which means

that, unlike the majority of Australians who rely on social security hand-outs, I

haven't been pissing my money up against the wall but saved it for my retirement.

Most of my money is invested in the sharemarket which has been showing good returns over the last year or so but is now reaching very volatile and worrying levels. Recent "corrections", or what I would call whopping big drops, in shareprices have convinced me that I ought to protect my savings a little more vigorously than merely taking the occasional look at the market.

Most brokers, and my broker Comsec in particular, accept conditional orders.

Conditional Orders provide me with a controlled entry and exit strategy

for a particular share. I can identify specific shares and instruct

the broker to place these on the market to purchase or sell when the price reaches

a pre-determined level. One of the biggest benefits of conditional orders is that it allows me to

make sensible, considered decisions before I feel the pressure of a volatile market. It allows me to carry

on with everyday life (or indeed go off to some remote South Pacific island as I plan to do in a

short while) without having to constantly monitor the market.

Most brokers, and my broker Comsec in particular, accept conditional orders.

Conditional Orders provide me with a controlled entry and exit strategy

for a particular share. I can identify specific shares and instruct

the broker to place these on the market to purchase or sell when the price reaches

a pre-determined level. One of the biggest benefits of conditional orders is that it allows me to

make sensible, considered decisions before I feel the pressure of a volatile market. It allows me to carry

on with everyday life (or indeed go off to some remote South Pacific island as I plan to do in a

short while) without having to constantly monitor the market.

- Stop Loss

- Buy Gain

- Supporting Buy

- Resistance Sell

|

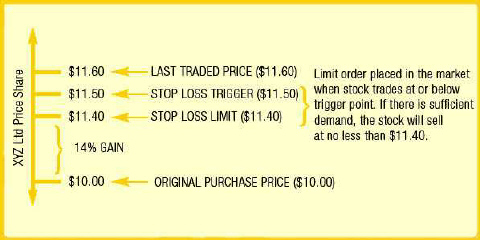

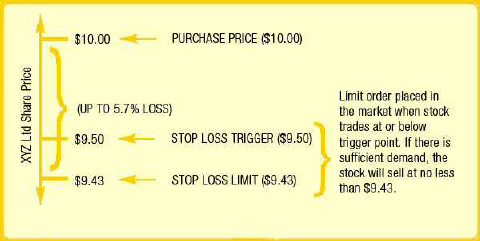

What is a Stop Loss? A Stop Loss is an instruction for a particular share in your portfolio to be placed for sale on the market when it trades at a pre-determined price. You decide which share you wish to sell, and set an acceptable exit price below the share's current trading price. Imagine you own shares trading at $10.00 and you want to ensure that if the stock falls, you sell out at no less than $9.43. You would set a Stop Loss Trigger at $9.50 along with a Stop Loss Limit Order at $9.43. Should the shares trade at the trigger point of $9.50 or lower, your limit order will be submitted to sell the shares at no less than $9.43. If there is insufficient demand above or at $9.43 your triggered order will remain in the market for 20 Trading Days. There are two ways to use Stop Loss

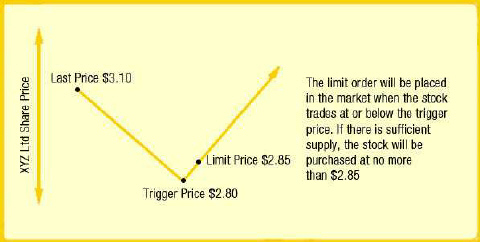

What is a Supporting Buy? A Supporting Buy also gives you a controlled entry strategy to a particular stock. You can instruct to place a buy order in the market when the price falls to a pre-determined level. You may wish to purchase a particular stock on the assumption that the price of that stock will fall. For example, say you have been watching the price of XYZ Ltd which has been trading at $3.10 and appears to be declining. You may wish to place a buy order if the price falls below $2.80 but pay no more than $2.85. In this instance, you could create a Supporting Buy Trigger with a trigger price of $2.80 and a limit price of $2.85. If the shares trade at the trigger price your limit order will be submitted to buy the shares at no more that $2.85. If there is insufficient supply below or at $2.85 your triggered order will remain in the market for 20 Trading Days. The following example is for illustrative purposes only:

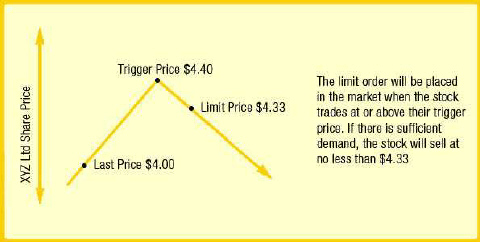

What is a Resistance Sell? A Resistance Sell is an instruction for a particular share in your portfolio to be placed for sale on the market when it trades at a pre-determined price. You decide which share you wish to sell, and set an acceptable exit price above the share's current trading price. This order type allows you to lock in your gains and sell if the market moves upwards. If the price of a particular stock has been rising, you may wish to sell some stock if it reaches a particular price and take the gains. For example, let's say you have been watching the price of XYZ Ltd which has been trading at $4.00 per share and appears to be rising. You may wish to place a Resistance Sell Order if the price reaches $4.40 but sell at no less than $4.33. In this instance, you could create a Resistance Sell Trigger with a trigger price of $4.40 and a limit price of $4.33. Should the shares trade at the trigger price, your limit order will be submitted to sell the shares at no less that $4.33. Assuming there is insufficient demand above or at $4.33 your triggered order will remain in the market for 20 Trading Days. The following example is for illustrative purposes only:

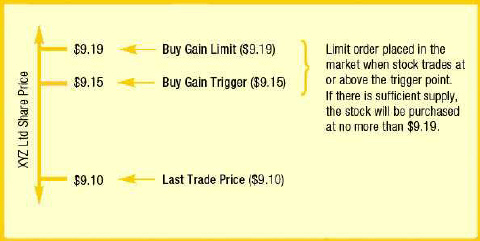

What is Buy Gain? A Buy Gain order can be used as a strategic order derived from your research using technical analysis. Many traders conduct charting analysis which they use to pre-determine their entry and exit points for a particular stock Buy Gain is a trigger that gives you a controlled entry strategy to a particular stock. You can identify a particular stock and instruct CommSec to place a buy order on the market when the price rises to a pre-determined level. This can allow you to buy into a stock that may be on the rise. A Buy Gain Order may be used in anticipation of momentum raising the price of a particular stock. If the price of the specified stock exceeds the Buy Gain trigger price you have set, your specified order will be placed. For example, imagine you are researching the share price of a particular stock called XYZ Ltd, which is currently trading at $9.10 per share. Your charting analysis shows that if the price rises to $9.15 the likelihood is high that momentum may keep the price rising. You could set a Buy Gain Trigger at $9.15 along with a Buy Gain Limit Order at $9.19. If the shares trade at the trigger point of $9.15 or higher your limit order will be submitted to buy the shares at no more than $9.19. If there is insufficient supply below or at $9.19 your triggered order will remain in the market for 20 Trading Days.The following example is for illustrative purposes only:

|

There is this story of an eccentric share trader who had an incredible track record. Each morning he would put a Coca-Cola bottle up to his ear, nod in a knowing fashion, and then place his orders. (This was before the days of mobile phones.) The other traders were perplexed and asked him what he was doing with the Coke bottle. He said that aliens spoke to him through the bottle and told him which trades to execute! He became the butt of their jokes until they realised that his track record spoke for itself. What do you think was the source of his success?

If your first thought was that aliens have inside information, perhaps you need to avoid Coca-Cola for a little while ... However, if you guessed that entry decisions have little to do with your ultimate success in the sharemarket, then you'd be on the right track. It's your EXIT strategies that will ultimately determine your trading success. The golden rule of trading is: "Keep your losses small and let your profits run." And it is Stop Loss orders that keep your losses small! It's a bit like putting a stone behind your car's wheel when you park on a decline: the handbrake may hold but just in case it doesn't, there's always the stone ...

|

I have placed a handful of Stop Loss orders already.

Unfortunately, with a large portion of my portfolio in mining shares,

they only "lock in" the gains

remaining after China unexpectedly raised interest rates and base metal prices fell.

My initial stop losses will help me to prevent my remaining equity from

washing away but as I get better at it, my goal will

transform from protecting my equity to protecting my profits.

Setting stop losses is a skill I will continue to

refine and perfect throughout my trading activities.

I try to learn from every trading experience, whether

I incur a win or a loss. As the Dalai Lama says, "When you

lose, don't lose the lesson."

I have placed a handful of Stop Loss orders already.

Unfortunately, with a large portion of my portfolio in mining shares,

they only "lock in" the gains

remaining after China unexpectedly raised interest rates and base metal prices fell.

My initial stop losses will help me to prevent my remaining equity from

washing away but as I get better at it, my goal will

transform from protecting my equity to protecting my profits.

Setting stop losses is a skill I will continue to

refine and perfect throughout my trading activities.

I try to learn from every trading experience, whether

I incur a win or a loss. As the Dalai Lama says, "When you

lose, don't lose the lesson."

However, not everything about investing is about money. As Marc Faber, the world's best-known contrarian whom I much admire, states on his website The Boom, Gloom & Doom Report, "Today's society is obsessed with money. But the best investments for you may be in your own education, in the quality of the time you spend with the ones you love, on your own job, and on books, which will open new ideas to you and let you see things from many different perspectives." He also reminds us, "Don't read only for the sake of acquiring money and knowledge; read also for the beauty of the language and for the pleasure that a well-written report or book can give you."

Best wishes and

from us all!

Peter & Padma & Malty & Rover

& Rover

riverbend@batemansbay.com

10 May 2006